On the occasion of World Creativity and Innovation Day, a senior leader at my organization requested employees to share what they think is the best innovation so far. My response was for an innovation that happened in the recent times and has a huge impact at scale:

“Unified Payments Interface aka UPI is the best innovation in recent times. When I have pay rent, most house owners only accepted it as cash. The same is the case with small shops that does not have credit card processing facility. I ll have to withdraw cash from ATM, give it to the house owner or shop keeper and they visit bank to deposit it in their accounts. UPI has removed the friction and made this process extremely seamless. I need not visit ATM and the receiving party need not visit the bank. Neither do we need to remember the account numbers. Instant account to account transfer using phone numbers or QR codes. Even Uber/Ola drivers who refuse card payments, accept UPI transfers. Over the course of next few years, UPI can eliminate the need for ATMs, that are kept in AC rooms, guzzling lots of energy.”

Ref: https://www.npci.org.in/what…/upi/upi-ecosystem-statistics

The Challenge

My personal story: I have family members struggling with anxiety and depression. While learning UX, and designing applications for social good, I picked the theme of helping people overcome stress, anxiety, and depression. The objective is to help people regain their peace of mind. The first prototype on this theme was FocusOn, followed by BeeCautious. From interactions with family members and friends, I saw that poor financial management leads to lots of stress and anxiety. With UPI gaining popularity in India, I explored on how this can be leveraged to solve for personal financial management.

The Approach

Followed the Design Thinking framework and this case study is focused on conducting UX Research, identifying Key Insights and building the Sitemap.

The Research Goal

Can UPI help families & individuals, manage their personal finance, meet financial goals and ultimately achieve peace of mind?

Research Questions

- What are your predominant sources of income?

- Is your income regular like salary or depends on business?

- What’s your saving plan?

- Do you have an emergency fund?

- Do you have sufficient insurance?

- How do you use UPI?

- Please tell me which UPI apps you use?

- Please show me, how you use the UPI app?

- Please walk me through the process of paying at stores?

- Please tell me one feature you feel is missing in the UPI app?

User Research Summary & Methodologies Used

Did user interviews, contextual inquiries, diary studies, created empathy maps and came up with three different personas & problem statements.

Pondered on, how might we try to address a few of the user problems, ultimately helping them in achieving peace of mind and came up with a sitemap.

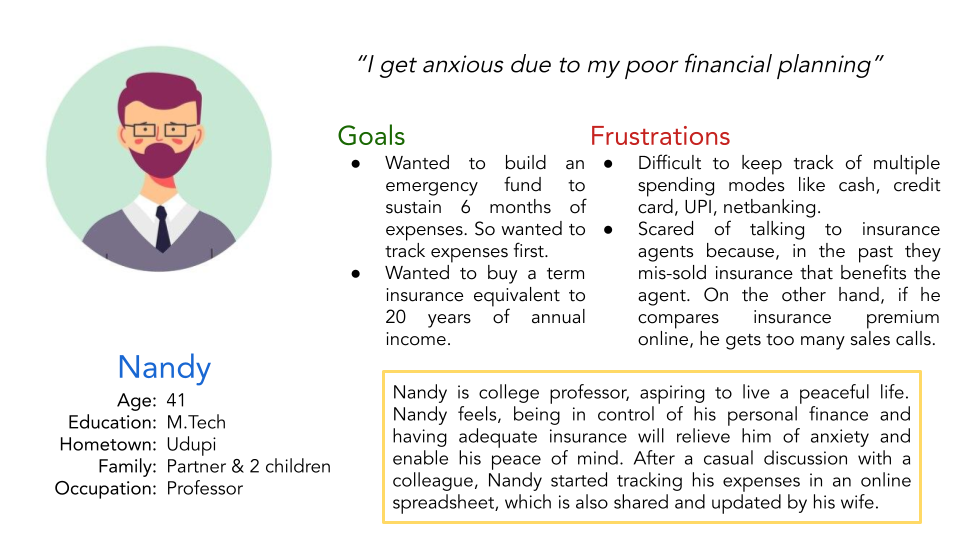

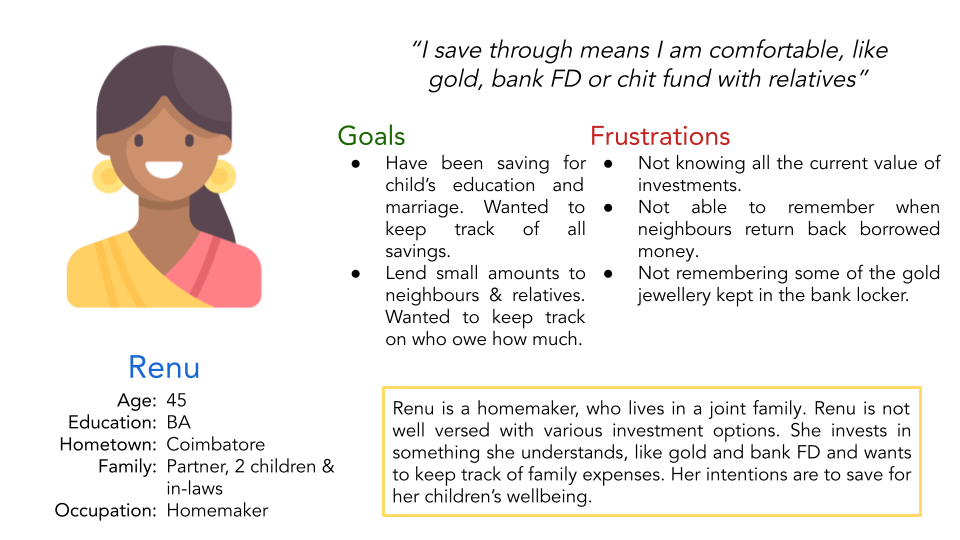

Personas: Nandy, Renu & Somu

Problem Statements

Nandy is a working professional who needs to track expenses, set aside money in an emergency fund, and manage the personal finance, because financial mismanagement and not being prepared for the future, leads to extreme anxiety.

Renu is a homemaker, who needs to track family’s savings because she needs sufficient money for her children’s higher education and marriage.

Somu is a spice trader, who needs an easier way to track amount receivables because writing them in a notebook, is not helping him much as he forgets to check it often.

How Might We

Only a small percentage of the population are financially literate and very few percentage of the population save from their earnings.

- How might we deliver financial education?

- How might we help people understand savings, investment, debt & budgeting?

- How might we help the user understand index funds?

- How might we help the user understand SIP (Systematic Investment Plan)?

- How might we help the user be a consistent and a disciplined investor?

- How might we encourage users to restart saving in case they fail to achieve some financial goals?

- How might we help people plan their finances and reduce stress?

- How might we nudge the user to create and follow a budget?

- How might we nudge the user to save for retirement?

- How might we nudge the user to save an emergency corpus?

- How might we nudge the user to buy a term insurance?

- How might we simplify taxes for the user?

- How might we enable the user to start a SIP (Systematic Investment Plan) & invest in low cost index funds?

- How might we nudge people to transfer funds through UPI, instead of using cheques?

- We are read news that cases of dishonoured cheques aka cheque bounces are on the rise. In a cheque transaction, the payer gives a monetary commitment to a payee by means of a cheque. The payee, deposits this cheque in the bank. The payer’s bank transfers the funds from the payer’s account to the payee. However there are circumstances when a cheque can be dishonoured, like:

- The issuer of the cheque did not have sufficient balance in the account

- The signature on the cheque did not match exactly

- The account numbers fail to match

- The cheque is disfigured and damaged

- The cheque has expired

- There is a problem with the date of issuing the cheque

- The issuer may choose to stop the payment.

- An efficient way to avoid the hassles of cheque being dishonoured and to avoid burdening the courts with cases of dishonoured cheques, is to bank digitally, use UPI.

- We are read news that cases of dishonoured cheques aka cheque bounces are on the rise. In a cheque transaction, the payer gives a monetary commitment to a payee by means of a cheque. The payee, deposits this cheque in the bank. The payer’s bank transfers the funds from the payer’s account to the payee. However there are circumstances when a cheque can be dishonoured, like:

- How might we enable people to create digitally signed monetary contracts, using UPI based apps or integrate with contract management systems?

- Ex1. A UPI based contract detailing a house owner paying an interior designer for a work, with details like advance paid, work to be done with timeline and the balance amount to be paid after the completion of the work.

- Ex2. A person Alpha, asks his friend Bravo to lend him money. Bravo can create a digital agreement like the term of loan, whether it has some interest or it is interest free out of goodwill, expected time of repayment..etc and request Alpha to digitally sign the term before accepting the loan. “Read & Sign this digital contract, to accept the money lent by Bravo.”

- Enabling users to create digital contracts can greatly reduce the chances of litigations and the unwanted burden on courts.

- How might we enable house owners to create digitally signed rental agreements after receiving advance amount for a house and digitally signed monthly rent receipts to share with tenants? This will in turn make it easy & transparent for people to claim House Rent Allowance (HRA) tax exemption. This can also be used to send a digital notice in case the owner wants the tenant to vacate the house after the agreement period.

- How might we enable the shops or “Point of Sale” machines, to share back the invoice and any warranty cards, digitally to the UPI app.

- Ex1: When a user purchases at supermarket and pays through UPI, the user mostly receives printed invoice with details of all the items purchased and the cost. Most users discard the paper bills after reaching home. If payment comes from UPI, instead of sending the invoice to the printer, what if the invoice is shared back to the same device from which the payment was made and stored in digital wallet.

- Ex2: When the user pays to the dentist after consultation, the user has never received a receipt or bill. What if the dentist, after receiving the payment through UPI app, can share an invoice back to the patient. What if the dentist’s UPI app shows, generate receipt option, with easy to select treatment options, its associated costs, tax and all other details normally found in a cash receipt, which can be used to quickly generate receipts in a few secs and shared back to the phone from where money was received. To avoid the dentist from storing the patients phone number and spamming later, there can be mechanisms to share receipts without obtaining the phone number.

- Ex3: When user refuels her/his vehicle and pays at petrol bunks, and pays through UPI, What if the UPI app can create a label of his vehicle type and vehicle number. Ex. Maruti Swift: IQ 01 AM 3499 and add that as note/comment to payment. What if, the petrol bunks can have a low energy consuming soundbox with big display that can that can be placed near the petrol dispenser and display the amount received from the customer or the vehicle no. The label can be tagged and displayed alongside each refuel payment acknowledgement for easier visibility and acknowledgement, thereby improving trust and increasing the speed of payment. What if the same display has generate receipts option, which can be shared back to the user digitally. These digital receipts will be helpful for users who submit claims for fuel allowances and also to generate a report on how much she/he spent on fuel.

- How might we help the user to write a fool proof will digitally and get it registered?

- How might we improve the user’s peace of mind?

- “Personal finance is only 20% head knowledge. It’s 80% behaviour!” – Dave Ramsey

- “In fact, what determines your wealth is not how much you make but how much you keep of what you make.” – David Bach

Research Insights

The insights from the research will help in designing delightful experiences and help users improve their peace of mind. Research revealed that the poor financial management leads to anxiety, which can be addressed to some extent by analyzing the expenses, taking adequate health and life insurance and having an emergency fund.

Budgeting & Analyzing Expenses

- Looked closely at the users’ current tracking methods like Google sheet, notebook and billbook.

- The fist tab of the Google sheet is “Expenses 2023.” The user has the Google sheets open on his computer browser all the time and has kept it as the first tab. Enter expenses on daily basis. The user’s partner doesn’t have a computer and has installed Google sheets on mobile. She doesn’t feel comfortable to open Google sheets, scroll a lot, and also find it difficult to select the right cell on the sheet to enter expenses, save and close. So because of these difficulties, she doesn’t regularly update her expenses on Google sheets. She sometimes shares big expenses to her partner on WhatsApp and requests him to add. The user feels, if adding expenses is as easy as texting on WhatsApp, she might regularly update it.

- The user has a tab named subscriptions, where he has entered his movie watching subscriptions like Hotstar, Amazon Prime, Netflix, Magazine Subscriptions, News Paper Subscriptions, Milk…etc. This helps the user to be conscious of unwanted subscriptions and cancel them.

- How might we help users to manage finance easily through mobile?

- The user wants to track expense, analyze and gain insights on his nonessential spending and make adjustments to spending and saving habits, so that the financial security is not at risk.

- The user is looking to add category/labels to expenses so as to track where he spends most, which ones are essential spends and non-essential spends, create a budget and control unwanted expenses. Currently, the user has an online Google sheet titled “Family Expense Tracker.” In the expense tab, the user has six columns viz: Date, Expense, Amount, Spent By (the user or his partner), Category (the user has dropdown with options Groceries, Snacks, Parents, Cab, Medical) and Sum (monthly total of expenses). Another interesting things the user showed on his sheet was, he did Ctrl+F and searched “Haircut” and showed he had 7 haircuts in the 2023 and then filtered to show how much he spent on it.

- The user doesn’t want too many categories. That’s demotivating. Wanted it simple. The user tracks grocery expenses and other essential home expenses. The user wanted to calculate how much he spends on groceries each month. The user wanted to see past grocery expense and track inflation. Ex. How much did a kg of tomato cost last month vs this month. The user wanted to track how much he spends on snacks so that he can make decide on how to reduce snacking and improve his health.

- The user occasionally buys dosa batter at shops nearby. The user sometimes purchases batter from a popular brand, and remembered it cost Rs. 35 per kg. Once when the user had gone to a supermarket, the same batter was sold there for Rs. 60 per kg. The user then started noting down prices of certain products and compare it periodically and felt it also helps to track inflation. So the user wanted an easy option to note down how much rice, atta and a few other essential items costs per kg each month and compare. Similarly, the user wanted to track rent per sqft for any year and locality.

- To start simple, the user wants 4-5 main categories and later options of sub categories can be included.

- The user feels labels would help him as he might sometimes add multiple labels to a single spend.

- Ex 1: Grocery + Essential

- Ex 2: Rent + Essential + Monthly Recurring

- Categories to determine income

- Salary

- Business income

- Rental income

- Bonus

- Gifts

- Stock dividends

- Side hustles

- Categories and sub categories to calculate expenses

- Groceries

- Snacks

- Eating Out

- Home (Rent/housing loan, Maintenance, Home supplies, Maid, property tax, home decor)

- Clothing & Footwear

- Personal care (Haircut, Beauty products)

- Jewellery

- Health (Insurance, Doctor Fees, Medicines, gym)

- Auto (Insurance, Maintenance, Fuel, Parking, Roadside assistance)

- Entertainment, Leisure, Travel & Holiday (Movies, Music, Streaming, Sports, Picnics, Holidays, Hobbies, travel insurance, party, club membership)

- Electronics

- Bills & Subscriptions (News paper, Electricity, Water, Gas, Mobile, Internet)

- Education & Learning (Fees, Courses, Books)

- Children (Education, Dresses, Classes, Toys, Diapers, Medicines)

- Money given to parents

- Gifts & Donations

- e-commerce payment

- In-store payment

- Taxes (Wanted to know how much tax I have paid in a year)

- User pays at tea shop using UPI app. The app presents some labels/notes. But the user is not picking any because he doesn’t know how that will be useful. User wants labels that he can create, like creating labels on Gmail and select a label while paying.

- User says payment page needs to have labels to tag, but is in a hurry to enter pin on that page. Will showing labels post payment too help?

Sample screens to assign & view categories (designed using Figma)

- Do you feel, opening the app at tea stall, adding the amount and then entering the PIN, a painful process? The user says, he is used to it daily and it feels like a ritual. While he asks the tea vendor, 1 ginger tea, the user is parallelly scanning the QR code and much before he gets the tea, he finishes the payment and waits for the tea.

- The user goes on a holiday, adds the expenses in his tracking sheet. Later, the user adds one more category like “July 2023-Hampi trip” and analyses how much he spent for a holiday inclusive of travel, food, stay, recreation and other expenses. The user was using Splitwise during trips.

- The user renovates his house and adds expenses to his tracking sheet. However, like tracking holiday expenses, the user looks for option to add another label and analyse how much he and his partner spent for house renovation.

- The user has a wedding in his family and he is taking care of the financial details. The user intends to track all expenses related to wedding.

- Like adding categories, the user looks for options to create events/labels like the ones presented above. Ex: Holiday, House Construction, Wedding, Higher Education, Cardiac Surgery costs…etc.

- The user receives lumpsum cash. Ex. Annual bonus from company or PF(Provident Fund) amount during retirement. After a few months, the user wonders where all the money went. How might we help the user track and analyse on how he spent the bonus or PF money? Can we add labels to spends. Ex. Spent from 2023 Annual Bonus.

- The user wishes to have another label/category viz. Wants/Needs. Ex. of Wants: Streaming, Subscription, Dining out, Shopping spree, entertainment, travel, luxury upgrades, other desires.

- The user wants to set goals to control non-essentials spends and track progress. What expense do I want to limit? Ex. Eating out less, spending less on smoking, cancelling unused subscriptions…etc

- “Beware of little expenses. A small leak will sink a great ship.” – Benjamin Franklin

- The user wishes to have a label/category viz. Online/In Store and later wanted to analyse on how much the user spent on online/ecommerce purchases vs in store purchases.

- Spending triggers – The user bought a small laptop table for Rs. 1500, that looked like a great offer. It was broken in 3 months. Ended up buying 3 more such cheap furniture. Felt cheated. Later realised there is no value for money in cheaper options. Because of purchasing something due to urgency, bought something that he didn’t like. Visited local shops and purchased good quality table that was not very expensive, still lasted for few years. Also buys branded quality jeans, which lasts for 3-5 years. Sustainable options. The user has a Notes app on his phone, where he lists down his aspirational items to buy, and buys one by one as his budget permits. Sample of the user’s note: A good quality formal black shoes, a Victorinox Swiss Knife, a comfortable travel trolley, a recliner sofa.

- How might we help users create a shopping Wishlist and plan the purchase so that it doesn’t burden the user’s budget?

- How might we help the user create goal based savings?

- User wanted to calculate his hourly earnings based on monthly salary. If tempted to indulge in something avoidable, wanted to see how many hours he has to work, to compensate for the indulgence

- The user swipes credit cards for multiple purchases which adds up to big sum and is surprised when he receives a huge bill. To avoid this the user has a second bank account, where he transfers approx Rs. 20,000/- at the start of the month and uses only for UPI purchases. Why the user transfers money to a different account which he uses only for UPI transfers? The user says, in worst case of fraud, he only loses money he can afford to lose. The user feels apart from this, if his credit card spend can also be tracked on the UPI app he is using and prominently displayed like ” Rs. 55,000/- spent till date on credit card this month” the user can be conscious and plan to pay without overburdening his finances.

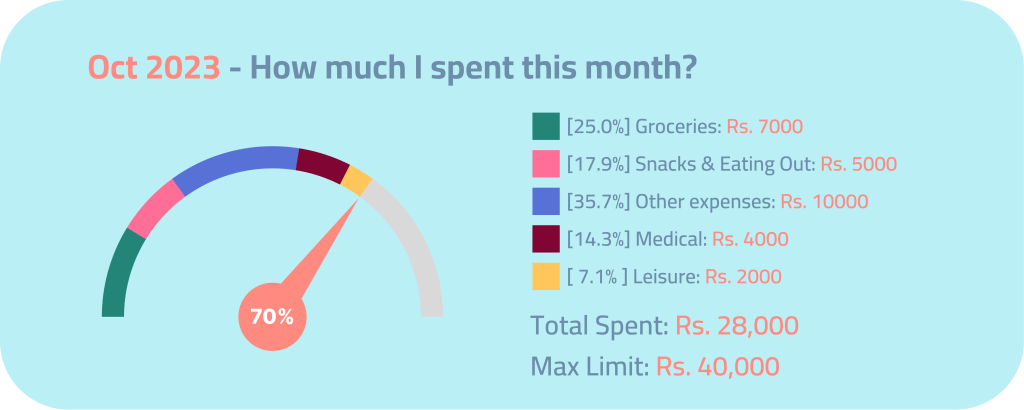

- The user wants to set monthly budget and festive season purchase budget and track. The user feels if his UPI app shows a Spending Monitor on how much has been spent till date in a particular month, like shown below, then he can be conscious not to overspend.

Spending monitor cards (designed using Figma)

Planning For Emergencies

- The user intends to calculate his monthly expenses and save 6 months of expenses in an emergency fund so as to sustain during emergencies or periods of no income.

- How might we help the user to build an emergency corpus? Can they open a simple recurring deposit account? Can they setup automatic transfers at the start of every month?

- The user wanted to keep some buffer cash for unexpected expenses. Currently one user transfers a portion of cash to a different bank account which he doesn’t use regularly so that some amount of cash is available.

- The user intends to buy and also track existing insurance he and his partner has, so as to be sure his insurance is approx. 20 times his annual income.

- The user wants to make sure he and his family have adequate health insurance.

- The user is scared of talking to insurance agents or bank executives selling insurance because in the past they mis-sold policies that benefits the agent, rather than covering his actual insurance needs. On the other hand if he compares insurance policies and premium online, they make him enter his mobile number and authenticate using OTP, post which he gets too many sales calls, which he feels is very irritating. Probed, how the user tackles this. The user said, he puts the phone on Do Not Disturb mode, almost daily and the phone only rings when he gets calls from starred contacts, who are his family members. Later he sees TrueCaller app to see if any of the missed calls were important. On days he is expecting delivery of goods or food he ordered, he removes the Do Not Disturb mode so that he doesn’t miss those calls.

- The user had purchased multiple insurance as investment, which provided meagre returns. Cajoled by sales tactics of friends and relatives who were insurance agents. The user listed down all his insurance in the excel, analysed the insurance needs, made sure he has sufficient term insurance and cancelled the rest as he felt, even if the premium can be invested in bank FD, he would get better returns than what the endowment policy would give.

- The user was struggling to find clarity on various insurance policies. The user understands what is a term insurance policy, but doesn’t understand what a rider means, what an accident cover means. Same way the user doesn’t understand various terms in a health insurance policy. The user doesn’t know, what is a top-up and super top-up. The user is not able to decide what is the right amount of cover he needs.

- How might we help the user in buying insurance? A user guide that is legible and explains in clear and simple terms, like explaining to a school going child, on what are various insurance and what are the differences between multiple insurance options. A questionnaire prepared by insurance experts, which asks for the age, gender, employment, income level, whether single, married, married with children, married with grown up children, retired, current family expenses, anticipated future expenses, existing assets, outstanding debts…etc. and helping users to determine different insurance needs like life insurance, health insurance, accident insurance, property insurance, vehicle insurance and also assist in deciding if the user can afford the premium and the various premium payment options like increasing cover, single premium, limited premium payment period, staggered payouts…etc.

- How might we nudge the user to review all his insurance policies and re-evaluate the ones don’t satisfy the real insurance needs?

- Like how the UPI app is able to retrieve the account details linked to a phone number, What if the UPI app is also able to retrieve all insurance policies linked to a user’s phone number, which in turn will help the user to assess if they have sufficient insurance?

- “A big part of financial freedom is having your heart and mind free from worry about the what-ifs of life.” – Suze Orman

Streamlining Savings

- User is looking for options to create short term goals, save for it and track the savings. Ex. Opening a recurring deposit and saving to buy a laptop.

- User is looking for options to create long term goals, save for it and track the savings. Ex. Investing on monthly basis in an index fund, for son’s higher education, for down payment to buy a home, car, to renovate house…etc.

- “The winning formula for success in investing is owning the entire stock market through an index fund, and then doing nothing. Just stay the course.” – John Bogle

- How might we help the user to achieve the above goals? Provide option in the UPI app for goal based savings and automate the savings till the goal is achieved. It can be long term savings or short term savings. Nudge with notifications once he receives salary, to invest a part of that.

- How might we nudge the user to save for retirement? Provide options for users to invest in pension schemes and low cost index funds.

- How might we help the users create savings plan that are not unrealistic but are practical and has a timeline attached.

- How might we nudge the user to do a monthly spending review, reduce unwanted expenses and save/invest better?

- How might we nudge the user to do a monthly investments/savings review? Are we a disciplined investor? Habit tracker?

- The user understood what is a SIP but is not able to understand what is a direct plan and a regular plan. How might we educate the user on the difference between a direct plan and a regular plan?

- The user said he contributes to Google maps, as a guide, because he is motivated when he receives points and moves up the levels.

- How might we gamify saving/investing and reward achievements?

- The user was part of a team in a month long walkathon. They received updates on daily basis as to which team is on top of the chart. Being part of a team made him feel accountable and every team member made sure to walk enough steps so as to bring their team on top of the chart.

- How might we gamify to help users save better?

- When the users tries to liquidate long term savings, educate them on the power of compounding.

- The user and his partner want to keep track of all their investments, jewels, and assets owned. Can the UPI app have a financial notes section?

- User needs an option to track her chit fund contributions. Can they create notes on monthly contributions, total amount accumulated, when & how much they withdrew? The users I see, who are saving through chit-funds are not digitally savvy and mostly have feature phones. They are part of chit-fund groups because relatives or neighbours are running them and they need not travel to banks and also feel safe to some extent. There are also similar schemes run by self help groups.

- The user keeps track of his investments in stock using Moneycontrol, though his investing app also shows the current value of the portfolio. He compares his portfolio on the stock investing app he uses, with the portfolio he has created for tracking on Moneycontrol, once in a few months and makes sure the stocks are intact.

- The user has written in her diary/notebook the list of jewels she possesses and the ones she has kept in the bank locker. Can the UPI app help users to create such notes? Will storing these details on phones be personal security risk?

- The user has a pouch in his cupboard, which is full of bills and warranty cards. The user says, if he purchases items like TV, he immediately clicks pictures of the bill and warranty card on his phone and adds them to “Bills” folder in his photos app. Similarly, the user has the habit of taking pictures of medical prescriptions and storing it on “Medical Prescription” folder on his photos app. The user was having Gmail, Google photos and Google drive on his mobile. The user feels if there are some default folders viz: “Bills,” “Warranty Cards,” & “Medical Prescriptions” that are shared and synced across Gmail, Google Photos & Google Drive, then it would be easy to manage important docs, irrespective of if it is an image, pdf or other file formats and search later.

- How might we help the user with storing important bills, warranty cards & prescriptions on his phone or UPI app and help user save some real money or order medicines if need be?

- The user currently has a tab on his expense tracking sheet, named subscriptions, where he has entered his movie watching subscriptions like Hotstar, Amazon Prime, Netflix, Magazine Subscriptions, News Paper Subscriptions, Milk…etc. with subscription end/renewal dates, monthly/yearly cost and the card used for each subscription.

- How might we help the users to list all subscriptions, track and cancel unused subscriptions?

- Many dream of a retired life with ample free time and enough money. To make this a reality, the user has to save regularly and save enough. How might we help users to calculate retirement corpus: For example, if one retires at 55 and expects to live until 85, he needs a corpus worth 30 times his annual expense, and if inflation is factored in they retirement corpus has to be more that 30 times annual expense. Can the UPI app provide options to know the users retirement corpus and help him plan and save, to achieve his/her retirement goals?

Debts & Receivables

- User, who is a wholesale dealer has supplied good to shops. He wants to add them as receivables, set deadline, send reminder a week before that and then send alerts if the user hasn’t received money beyond deadline. The user currently sends the physical copy of the bill during delivery and later sends the photo of the bill on WhatsApp to remind the shopkeeper for the pending payment. What if the user can add photo or generate the bill on UPI app, share it with shopkeeper and the shopkeeper can acknowledge on UPI app Ex. “Received Goods, Payment Pending, 60 days left” and the wholesale dealer can acknowledge on payment receipt Ex. “Payment Received for bill no. 123” and the wholesaler can see data on how many days the shopkeeper took to send money for goods received.

- The user intends to track amount he had lent/receivables, borrowed and the loans he needs to pay for.

- How might we help users & small businesses to have an overview of all the loans and amount receivables?

- Currently, one of the user also has two tabs on the Google sheet viz. “Loan from” and “Lended to”

- In the “Loan from” sheet, first row, the user has entered the total amount of loan, EMI per month, pending EMIs, name of the bank and loan no. In the second row, the user has added “Borrowed Rs. 50,000/- from Kavin on 29-Aug-2023. Returned Rs. 30,000 on 02-Sep-2023. Balance to return Rs. 20,000/-

- In the “Lended to” sheet, first row, the user has written Rs. 15,000/- lent to Udhay on 10-Jul-2022. Received Rs. 5,000/- on 02-Mar-2023. Balance to receive Rs. 10,000/- The last column has the balance to receive and the user click the top of column and checks the sum of money to receive from various people.

- The user who is a homemaker and contributing to Family Expense Tracking sheet has a sheet titled “Maid Advance.” The user’s housemaid had borrowed from someone who was charging exorbitant interest. So to pay them back, the housemaid had borrowed interest free money from the user on promise that a portion of the money can be deducted from her salary every month. So the user has 3 columns. Devi akka Advance – Rs. 50000, lent on 20-Jun-2023. Jul – 2023 deduction Rs. 1000. Balance Rs. 49000. Aug 2023 – given Rs. 500 extra. Balance – Rs. 49500.

- How might we help the user to have an overview of all the amount receivables? Can they add notes to UPI app?

- How might we nudge the user to list all debts the user owes to banks & individuals and compare all the debts (Loans, Credit Card, Upcoming Payments) and help the user create a plan, to systematically pay off the debts & credit card dues and closing the ones with highest interest rate first.

- Help the user to calculate the total EMIs for every month and make sure it is not more than 40% of his monthly income so that his monthly finances are not strained.

- How might we help the user understand carrying forward credit card payments, the interest on that and their impact on the user’s credit score?

Simplifying Taxes

- The user also wanted handy information on how much taxes he has paid every year.

- The user wishes to import the tax deducted at source, from his payslip.

- The user wishes to enter buy price, buy date of a stock and its corresponding sell price, sell date and would like to be assisted in determining how much capital gains tax he needs to pay.

- The user wishes to generate digitally signed receipts for salary paid to house-help, driver, fuel charges and house rent, so that the same can be submitted to his employer to claim tax deductions.

Succession Planning

- The user also has two tabs on the Google sheet viz. “Nandy’s financial details” and “Partner’s financial details”

- In Nandy’s financial details tab, the user has entered the following details:

- PAN

- Details of bank account 1 and its no., name as per bank records, name of the bank, branch, IFSC code, if nominee added, the name of the nominee, if nominee not added, a bold text in red to remind user to add nominee soon.

- Details of investment account, demat account no., user id, linked bank account and it details, nominee name, address given in the account.

- In one row, the user has entered the life/term insurance policy details like policy no., insurance company name, name of the insured as per policy, name of the nominee, total amount insured for, premium paying term and the last column has premium paying date. The user feels he needs to be nudged about the premium due, a month in advance and be prepared to pay by the deadline. The user says, his insurance company also sends notifications through SMS and email and the upcoming premium payment.

- After collating personal financial details in one place, Ex. My Finance Info the user would like securely share with family. The user says he received his insurance document only through email. To keep the family updated, he printed 2 copies of the document and kept at his home cupboard. The user feels mobile phones are mostly locked and to keep family informed, we need printed copies of important document. So the user would like to collate all financial details and later generate a printable version in a single page or few pages.

- The user said his grand father had written in a diary about the bank and post office in which he had deposited his money and to whom he had lent money. The user is looking for a digital option where he can collate all his financial & wealth details. The digital option should be printable because the user feels he needs to print copies and store in his cupboard.

- How might we help the user with family sharing of financial details? Generate printable summary of finance details.

- The user wanted to collate all his financial information in one place. Ex. Income, Expenses, Bank Accounts, Credit Card, Investment Accounts, Loans…etc.

- The user would like to have his financial details like bank accounts, credit cards, insurance etc added to a list and wanted to do a yearly review to see if the nominees are updated properly for all his/her accounts. If not he wants to set reminders and complete pending actions like adding nominees, updating KYS…etc.

- The user would like to store his land records in a safe and share copies with his immediate family members.

- Rs 64,000 crore idle wealth lying unclaimed. Money lying in banks without inheritors. The users feel safe having money in the bank.

- How might we help the user to safely pass it on to their family?

- Write my will – Feuds within the family can erode the value of relationships. To avoid family disputes, the user believes in writing a will, registering it and sharing it with family members. Larger business can manage succession well. How can smaller business or families do. Seen family disputes and land lying vacant for long without use due to disputes.

- How might we nudge the user to add/review the nominees of all their accounts?

- How might we nudge the user to track all the power of attorneys given?

- How might we educate/guide the users to prepare/update the will and with succession planning?

- Can the user be nudged to jointly register property with spouse so as to make property transfer easier later? Can the government reduce stamp duty slightly when a house is registered jointly by wife & husband?

- How might we nudge the user to discuss the finances with family members?

- How might we help the users to track their net worth?

Reports

- The user wanted to generate weekly/monthly expense reports.

- The user wanted to generate reports like:

- How much did I spend on this holiday?

- How much did I spend on holidays this year?

- How much did I spend on this trip?

- Create trip group. Ex. “Pondy Trip-Oct2023” – Add group participants-Allow group participants to add spends related to the specific trip-If going Dutch, calculate total spend and who spent or owes how much.

- How much did I spend on groceries this month?

- How much of my spending was through e-commerce vs in-store payments?

- How of of reward points did I receive for amount spent through UPI or credit card and how much value the reward points provided?

- How much money will I need in emergency cash, to survive six months without a job?

- How much of credit card debt do I have?

- How much did I spend on my son’s marriage?

- Create group. Ex. “Murali’s marriage-Add group participants-Allow group participants add spends related to the specific wedding.

- How much taxes did I pay this year?

- How much did I spend on personal development this year? Ex. Books, Learning, Gym…etc.

- How much did I spend on fuel this year? Can the user generate receipts for fuel spends, so that the user can submit for fuel reimbursement or tax claims?

Resolutions

Help users to set quarterly or yearly financial resolutions.

I resolve,

- To create an emergency corpus.

- To read a book and improve my financial literacy.

- To review my insurance needs.

- To update nominees for all bank accounts.

- To achieve saving milestone.

- To raise my SIP by 10%

- To pay an extra EMI for home loan.

- To have a spend free weekend.

- To not fall for the word “Sale,” ask myself “Do I really need this?” and buy only what I need.

- To reduce my tendency to keep up with neighbours in terms of lifestyle and live within my means.

Sitemap

The Impact

Individuals & families who have adequate savings tend to be stress-free. Helping people plan and achieve financial freedom would enable user’s peace of mind and user loyalty. Freedom from worry & freedom from the fear of what-ifs, can increase ones productivity, thus contributing positively to the household and the overall economy.

“Financial freedom is freedom from fear.” – Robert Kiyosaki

A wealth of supporting resources:

How UPI became bigger than ATMs and credit cards – Times of India

People are living longer. So how can we build resilient economies and thriving societies? – World Economic Forum

Financial Literacy: The need of the hour – Gravitas Plus

Your Money and Your Mind with Wendy De La Rosa – TED Series

Wendy De La Rosa: 3 psychological tricks to help you save money – TED Talk

Elizabeth White: An honest look at the personal finance crisis – TED Talk

The 10 Best Personal Finance Resolutions For 2024 – Becoming Minimalist

Aisha Nyandoro: What does “wealth” mean to you? – TED Talk

Thasunda Duckett: 6 ways to improve your relationship with money – TED Talk

FIRE Movement – Money Secrets of People Who Retired Early – Reader’s Digest

19 Habits of People Who Are Great at Saving Money – Reader’s Digest

13 Things to Stop Buying That’ll Save You Tons of Cash – Reader’s Digest

50-30-20 Budget Rule: How to Make a Realistic Budget – Mint Notion

50/30/20 Budgeting Rule – Mint

Nine golden personal finance rules – Mint

10 financial planning thumb rules to manage money throughout your life – The Economic Times

Top 10 Money Drains (With Ways to Slow the Flow) – The Simplicity Habit

How to Manage Debt Effectively (6 Tips For Debt-Free Living) – Nourishing Minimalism

What is financial trauma? How to deal with it? Know from experts – Mint

Rs 64,000 crore idle wealth lying unclaimed: Here’s how you can claim it – The Economic Times

How to write a foolproof Will to pass on your assets smoothly – Moneycontrol

How young Indians can write an effective, fool-proof Will – Moneycontrol

Financial Happiness: How Americans Can Achieve It – Visual Capitalist

Can money buy happiness? – Empower

Luis von Ahn: How to make learning as addictive as social media – TED Talk

What Is Personal Finance, and Why Is It Important? – Investopedia

PS:

This case study is focused on conducting user research & identifying key insights. Thank you for taking time to go through my work! I m working hard and constantly learning to improve my design skills and specialise as UX Researcher. Your feedback will help become better 🙂

Email: ashokprabhut@gmail.com

At leisure, please glance at my thoughts & ideas: www.ashokprabhu.com

Very good article. Much informative and more insightful. Great work. Keep going

Superb

Very well researched, practical insights and tools to overcome some of the basic challenges. Nice work Man.